MyMilestoneCard

MyMilestoneCard

Blog Article

Are you struggling with your current credit card and seeking a more reliable option? Turn to MyMilestoneCard, a path that can ease you through money troubles and raise your credit standing. Credit cards should ideally promote smooth money flow without issues. To side-step typical failures, look toward MyMilestoneCard, an established solution to establishing or reinforcing your credit rating.

MyMilestoneCard is an unsecured credit card that allows users to build or restore their credit history. Although new card members usually start with a small amount such as a $300 credit limit, this card provides many advantages comparable to those of secured cards from well-established institutions, offering a good platform for credit building. The credit limit is established based on your financial situation at the time of approval.

After approval via the MyMilestoneCard website, cardholders will have access to a full suite of services from the Bank of Missouri in collaboration with Genesis FS Card Services. The services provided include a safe online account management system, by which cardholders can simply monitor their account information and manage their transactions online.

MyMilestoneCard – What is it?

MyMilestoneCard is a secured card offered by The Bank of Missouri and serviced by Genesis FS Card Services. It is tailored for people with poor credit or no credit score needed for milestone credit card at all to establish or re-establish their credit by paying an initial security deposit which becomes their credit line.

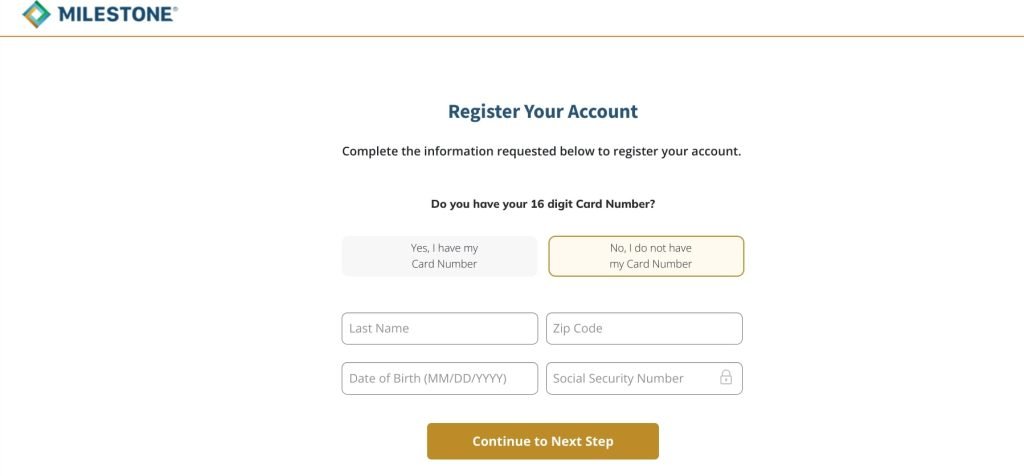

MyMilestoneCard Registration Process

To register for MyMilestoneCard and log in to your account, do the following:

Access the Internet: Begin by turning on your computer, laptop, smartphone, or tablet.

Connect to the Internet: Make sure your device is connected to a reliable internet connection.

Open a Web Browser: Open a web browser on your device to access the official MyMilestoneCard website at www.mymilestonecard.com.

Find the Registration Button: On the home page, identify the “Register” button, usually in the top right-hand corner or at the left of the page.

Click the Register Button: Click on the “Register” button to be directed to the registration page.

Input Required Information: On the registration page, input the following information:

- Last Name

- Zip Code

- Date of Birth

- Social Security Number (according to some sources, but generally account number, date of birth, and social security number for first-time setup).

Create Your Account: Proceed with the instructions to set up a username and password for your online account.

Complete Registration: Click “Next” to finish the registration process.

After you have successfully registered, you can then log in to your account where you can handle your card activities, view statements, pay bills, and others.

MyMilestoneCard Login Procedure

To log in to your MyMilestoneCard account, simply follow these simple steps:

Turn on Your Device: Begin by turning on your computer, laptop, smartphone, or tablet.

Get Connected to the Internet: Make sure your device is connected to a reliable internet connection.

Launch a Web Browser: Open a web browser such as Google Chrome, Safari, or Firefox to access the internet.

Go to MyMilestoneCard Website: Go to the official MyMilestoneCard website at www mymilestonecard com.

Enter Login Credentials: There are two spaces on the homepage: Username and Password. Put in the username and password that you set while registering.

Click the Login Button: Once you’ve entered your details, press the Login button to reach your account dashboard.

Advantages of Using MyMilestoneCard

Convenience: Access your account online 24/7 to review balances, transactions, and statements, and make or schedule payments.

Credit Building: The Milestone Gold MasterCard is structured to help you build your credit rating, even with a relatively low initial credit limit.

No Security Deposit Required: Unlike other cards, you won’t need to make a security deposit to start using your Milestone Gold MasterCard.

Global Acceptance: Accept your card wherever MasterCard is accepted, in over 200 countries.

Activating Your Milestone Credit Card

Activating your Milestone credit card is an essential step after which you can use your card to make purchases. The mymilestonecard activate card comes in a dormant state and needs to be activated to make it ready for transactions. Below is a simple guide on how to mymilestonecard.com activate:

Online Activation

Access the Milestone Website

- Open www.mymilestonecard.com or mymilestonecard/activate through your internet browser.

- If you do not have an account, click the “Register My Account” button.

Create an Account

- You need to insert your last name, zip code, birthdate, and social security number. Continue following prompts to fill in the registration information, such as selecting a username and password to utilize when you return to log in.

Activate Your Card

- Log in, and then go to the mymilestonecard.com activate page. Input the necessary card information, such as the card number and expiration date. Finish any other verification processes, such as responding to security questions or getting a verification code.

Phone Activation

- Call the Activation Number

- Locate the phone number on the sticker on your new card, typically 1-800-305-0330.

- Insert your milestone bank credit card login number, your security code, social security number, and the other details demanded by the automatic system.

Features of the MyMilestoneCard Login Portal

MyMilestoneCard login portal provides various advantages to cardholders in terms of enriching their experience with the card. Some of the most prominent features are mentioned below:

Accessibility: The portal is readily available for all the cardholders, making it easier for users to manage their accounts effectively.

No Credit Impact: Pre-qualification has no impact on credit scores, enabling users to check for options without risk.

Customizable Card Design: Customers can opt for their preferred card design, giving their financial tools a personalized touch.

Smart Technology: The company uses innovative smart card technology for safe transactions.

Free Online Access: MyMilestoneCard cardholders get free online access to their accounts, making it easy to manage their financial information.

No Security Deposit: Contrary to other credit cards, mymilestonecard card does not charge a security deposit, and hence, is more accessible.

Simple Registration and Login: Individuals can register and log in rapidly to begin utilizing their cards.

Online Bill Payment: Bills can be paid online through direct debit, making financial transactions simpler.

Digital Banking: The card has digital banking support, enabling customers to view and manage their bank statements online.

Flexible Account Management: Account information can be adjusted at any time, offering flexibility in managing financial data.

Credit Building: MyMilestoneCard assists clients in establishing a good credit record by reporting to the major credit bureaus.

Global Acceptance: The card is acceptable in more than 200 nations, providing global convenience for payments.

Why Choose Milestone Gold MasterCard?

Prequalification: Applying for the card won’t affect your credit score as much, making it a more secure choice for those who are worried about credit inquiries.

Low Credit Score Acceptance: You can apply for the Milestone Gold MasterCard even if you have a poor credit score, making it more accessible to others.

Personalizable Card Layout: Select the card layout that suits you, giving your money management tool a personal touch.

Login Portal Information for Milestone Gold Mastercard

The Milestone Gold Mastercard, issued by Bank of Missouri and serviced by Genesis FS Card Services, Inc., is a card designed to help individuals with poor or poor credit establish their credit history. The card is an unsecured credit card that does not necessitate a security deposit, and therefore it is available to people with not-so-great credit.

Key Milestone Gold Mastercard Features

Issuers: Issued by the Bank of Missouri and serviced by Genesis FS Card Services, Inc.

Credit Building: Reports account history to the three major U.S. credit bureaus, helping to build a regular payment history.

Mastercard Benefits: Offers Mastercard ID Theft Protection and Zero Liability Protection.

Credit Limit: The card has a credit limit of $700 with no credit limit increase option.

Basic Login Portal Information

To make payments, track account activity, and review transactions, log in on the Milestone site. This site lets you do everything from online bill pay to transaction review. Online payments are accepted, along with phone or mail payments.

Setting Milestones

If you’re looking for improved credit or would like to manage your financial milestones correctly, the following should be taken into account:

- Set Clear Goals: Determine what you want to do with your credit card, i.e., improve your credit score or manage spending.

- Monitor Spending: Keep track of your account activity to see if you’re keeping within budget.

- Make Timely Payments: Pay bills in a timely manner to keep a good credit history.

By doing these and using the Milestone Gold Mastercard wisely, you can improve your financial situation.

Why Credit Scores Matter?

Credit scores are vital to financial management, especially in the context of credit cards such as the Milestone Mastercard, which targets people with poor credit. Below is why credit scores matter and how they link to credit cards such as the milestone mastercard credit card:

Importance of Credit Scores

In milestone my account having a good credit score provides more leeway in selecting credit cards with favorable terms, including lower rates of interest and lesser fees. On the other hand, a poor credit score usually results in fewer alternatives, like the Milestone Mastercard credit card, that are specifically designed for people with bad credit.

Interest Rates and Fees: Credit card interest rates and fees are influenced by credit scores. Bad credit cards have higher APRs and charges.

Credit Limit: Better credit scores may have higher credit limits, while poor credit scores could have lower credit limits, as was the original $265 limit of the Milestone Mastercard.

Emergency Situations: During emergencies, the presence of a good credit score will assist in obtaining a new credit card in a hurry, perhaps with more favorable terms than secured or subprime cards or milestone card cash advance.

Applying for a Milestone Mastercard

With increased popularity, MyMilestoneCard can be readily applied for over the internet on www.mymilestonecard.com. Issued by a reliable credit card provider, it is a secure opportunity for individuals interested in building a strong credit record without the credit score needed for milestone credit card. The candidates need to fulfill certain milestone credit card requirements in order to get approved.

Age Requirement: The applicant should be 18 years and above to be eligible for the card.

Identification and Residency: A current U.S. identification card, permanent address, and Social Security number are needed.

Financial Requirements: Applicants need to have a bank account and meet the bank’s income guidelines.

Credit History: The card is specifically tailored for individuals with bad or no credit history, thus it is available to a broad spectrum of applicants.

Existing Accounts: Applicants should not have an existing account with a credit card in the same bank.

Conclusion

The official MyMilestoneCard.com website is designed to enhance user experience through immediate access to account management for old and new cardholders. Low credit limit on the card prompts spendthrift behavior. The Milestone Credit Card Login website has complete on-screen directions to ensure easy navigation for first-time users. In addition, it offers official regulations to allow users to get information about the policies and rules of the brand, creating a clear and easy-to-use context for efficient credit management. It improves general customer satisfaction and enables effective credit management.

FAQs

What is the Milestone Mastercard?

An unsecured credit card for individuals with poor credit.

What are the benefits of the Milestone Mastercard?

The Milestone Mastercard helps build credit and offers a relatively low APR.

Are there fees associated with the Milestone Mastercard?

Yes, annual fees and potential transaction fees apply.

How do I apply for the Milestone Mastercard?

You can apply online at www.mymilestonecard.com for according to milestone credit card requirements documents.

Does the Milestone Mastercard report to credit bureaus?

Yes, it reports to all three major credit bureaus.